Mumbai : Reserve Bank on Thursday retained the growth and inflation projection at 7.2 per cent and 4.5 per cent respectively for the current fiscal amid expectations of a normal monsoon.

In its last bi-monthly monetary policy review in June, RBI had projected real GDP growth and retail inflation at the same.

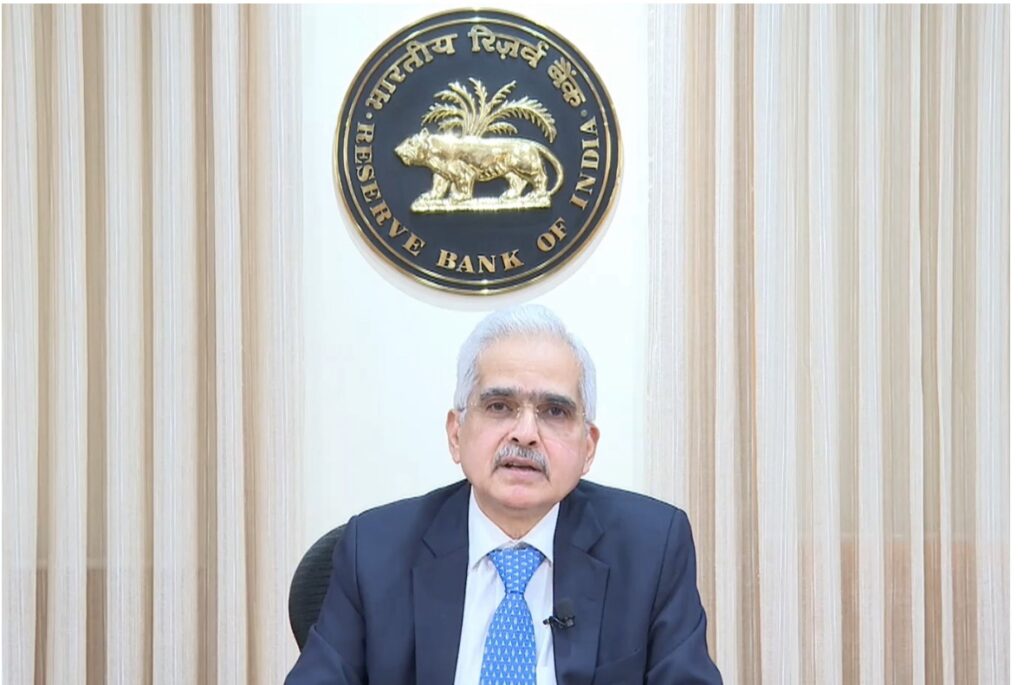

RBI Governor Shaktikanta Das while announcing bi-monthly monetary policy said that improved agricultural activity brightens the prospects of rural consumption, while sustained buoyancy in services activity would support urban consumption.

“The healthy balance sheets of banks and corporates; thrust on capex by the government; and visible signs of pick up in private investment would drive fixed investment activity. Improving prospects of global trade are expected to aid external demand,” he said.

The spillovers from protracted geopolitical tensions, volatility in international financial markets and geoeconomic fragmentation, however, pose risks on the downside, he said.

Taking all these factors into consideration, he said, real GDP growth for 2024-25 is projected at 7.2 per cent, with Q1 at 7.1 per cent; Q2 at 7.2 per cent; Q3 at 7.3 per cent; and Q4 at 7.2 per cent.

Real GDP growth for Q1 FY26 is projected at 7.2 per cent, he said, adding, the risks are evenly balanced.

“It may be seen that we have slightly moderated the growth projection for Q1 of the current year in relation to the June 2024 projection. This is primarily due to updated information on certain high-frequency indicators which show lower than anticipated corporate profitability, general government expenditure and core industries output,” he said.

On inflation, Das said, a degree of relief in food inflation is expected from the pick-up in the south-west monsoon and healthy progress in sowing and buffer stocks of cereals continue to be above the norms.

Besides, he said, global food prices showed signs of easing in July, after registering increases since March 2024.

Assuming a normal monsoon, and taking into account the 4.9 per cent inflation print in Q1, he said, CPI inflation for 2024-25 is projected at 4.5 per cent, with Q2 at 4.4 per cent; Q3 at 4.7 per cent; and Q4 at 4.3 per cent.

CPI inflation for Q1FY26 is projected at 4.4 per cent, he said, adding, the risks are evenly balanced.

Das further said that the headline CPI inflation edged up to 5.1 per cent in June 2024 due to higher-than-expected food inflation.

Fuel remained in deflation for the tenth consecutive month, he said, adding, that core inflation moderated to a historic low in May and June.

The high food price momentum is likely to have continued in July and large favourable base effects may, however, push headline inflation downwards during the month.

The impact of the revision in milk prices and mobile tariffs needs to be watched, he said.

Under the current monetary policy setting, he said, inflation and growth are evolving in a balanced manner and overall macroeconomic conditions are stable.

“Growth remains resilient, inflation has been trending downward and we have made progress in achieving price stability, but we have more distance to cover. The progress towards our goal of price stability has been uneven due to large and persistent supply side shocks, especially in food items,” he said.

RBI, therefore, need to remain vigilant to ensure that inflation moves sustainably towards the target, while supporting growth, he said, adding, that this approach would be net positive for sustained high growth.